Introduction

Time Series is a sequence of data that is present in intervals of time. These intervals can be hourly, daily, weekly, or any quantifiable repetitive duration of time. A sequence of these observations made over regular time intervals is called time series. Forecasting time series deals with predicting the next cycle or observation of events that would occur in a future-referenced time frame. We will walk through forecasting Time Series in this chapter.

Understanding the flow of Time Series Forecasting

/5-1.png.aspx;)

Sequence Analysis and its Importance

In the present era, every business is using Machine Learning to understand the behavior of their customers and forecast sales and acquisitions. Besides, time series forecasting has massive commercial and consumer marketing importance because things that are important to a business, like demand, sales quotes, number of people visiting a website, stock price predictions, etc. are essentially time series data where forecasting helps. We start the analysis by understanding numerous aspects of the nature of data and its dependency on time.

Panel Data: Panel is a time-based dataset that in addition to sequential data also contains one or more linked variables that are quantified for same periods of time. These dependent variables help in providing valuable insights for predicting the value of ‘Y’. One way to understand whether a dataset is time series or panel, is to understand if the time column is the only part of data that is affecting the outcome of the prediction.

Time series analysis is applicable to real-valued numerical data, continuous data, discrete numerical data, as well as discrete symbolic data (that is, series of characters, such as letters and words of a language).

Important Python packages and Libraries for Time Series Analysis

To analyze time series and to build prediction models on time series, let’s take a look at some important libraries and methods.

- Stattools: It is a PyPi package that implements Statistical learning and several algorithms for calculating inference in data. Supported in Python versions 3.6 and above.

- Pandas Dataframe Resample: Resampling is a technique used for changing the frequency of time series observations. Within pandas' data frames, the resample method makes this frequency conversion convenient. Pre-conditions required are, that the object must have datetime data type formats (datetime, datetimeindex, periodindex, timedeltaindex, etc.). There exist two resampling types, namely:

- Upsampling: The frequency of sample data is increased. For instance, changing a minute-based frequency to seconds.

- Downsampling: The vice-versa of unsampling. Example, changing a day-based frequency to months.

- pmdarima: Originally called pyramid-arima, pmdarima is a statistical library that aids in filling data voids in Python's time series. It contains a collection of statistical tests for checking stationarity and seasonality. Features such as differencing of time series and inverse differencing are also included.

Performing some Statistical Functionalities on Time Series data:

# Importing the basic preprocessing packages

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

# The series module from Pandas will help in creating a time series

from pandas import Series,DataFrame

import seaborn as sns

%matplotlib inline

# About the Data Set (Location: https://www.kaggle.com/sumanthvrao/daily-climate-time-series-data)

# To forecast the daily climate of a city in India

time_series = pd.read_csv('DailyDelhiClimateTrain.csv', parse_dates=['date'], index_col='date')

time_series.head()

>>>

meantemp humidity wind_speed meanpressure

date

2013-01-01 10.000000 84.500000 0.000000 1015.666667

2013-01-02 7.400000 92.000000 2.980000 1017.800000

2013-01-03 7.166667 87.000000 4.633333 1018.666667

2013-01-04 8.666667 71.333333 1.233333 1017.166667

2013-01-05 6.000000 86.833333 3.700000 1016.500000

# Below are a few statistical methods on time series that will help in understanding the data patterns

# Plotting all the individual columns to observe the pattern of data in each column

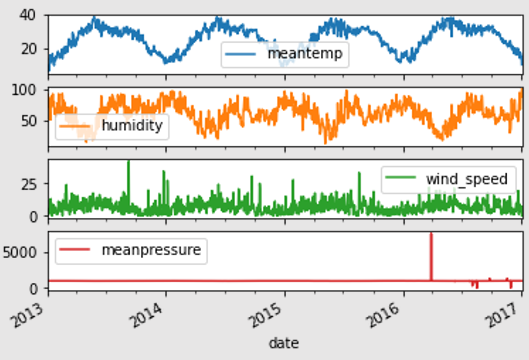

time_series.plot(subplots=True)

>>>

array([, ,

, ],

dtype=object)

# Calculating the mean, maximum values, and minimum of all individual columns of the dataset

time_series.mean()

>>>

meantemp 25.495521

humidity 60.771702

wind_speed 6.802209

meanpressure 1011.104548

dtype: float64

time_series.max()

>>>

meantemp 38.714286

humidity 100.000000

wind_speed 42.220000

meanpressure 7679.333333

dtype: float64

time_series.min()

>>>

meantemp 6.000000

humidity 13.428571

wind_speed 0.000000

meanpressure -3.041667

dtype: float64

# The describe() method gives information like count, mean, deviations and quartiles of all columns

time_series.describe()

>>>

meantemp humidity wind_speed meanpressure

count 1462.000000 1462.000000 1462.000000 1462.000000

mean 25.495521 60.771702 6.802209 1011.104548

std 7.348103 16.769652 4.561602 180.231668

min 6.000000 13.428571 0.000000 -3.041667

25% 18.857143 50.375000 3.475000 1001.580357

50% 27.714286 62.625000 6.221667 1008.563492

75% 31.305804 72.218750 9.238235 1014.944901

max 38.714286 100.000000 42.220000 7679.333333

# Resampling the dataset using the Mean() resample method

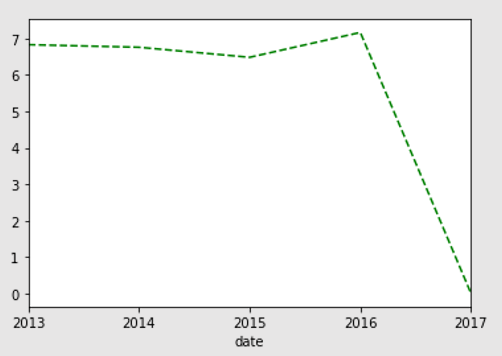

timeseries_mm = time_series['wind_speed'].resample("A").mean()

timeseries_mm.plot(style='g--')

plt.show()

# Calculating the rolling mean with a 14-bracket window between time intervals

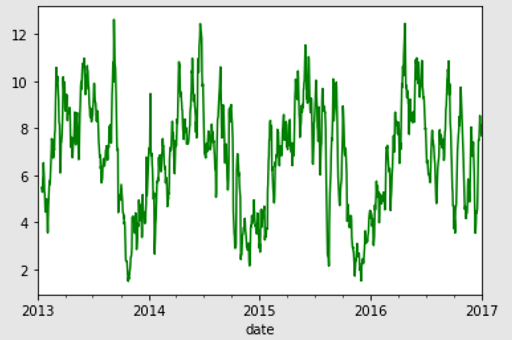

time_series['wind_speed'].rolling(window=14, center=False).mean().plot(style='-g')

plt.show()

>>>

# In the coming sections we will implement time series forecasting on the same dataset

Stationary and Non-Stationary Time Series

Stationarity is considered a feature in every time series. In case of a stationery series, the values of the time series are not a function of time. Which means that measure like mean, variance, and autocorrelation of current values with past values, are all constant over time. A stationary time series is also not affected by seasonal changes. Almost every time series can be made stationary by applying appropriate transformations.

Making a Time Series Stationary

Time Series data can be made stationary using any of the following mentioned procedures:

- Differencing the series once or more: The concept of differencing states that subtracting a series value in the current time by a value of the same series in a previous unit of time will make it stationary. Meaning, subtracting the next value by the current value is differencing.

- For example, consider the following series: [1, 5, 2, 12, 20]. First differencing gives: [5-1, 2-5, 12-2, 20-12] = [4, -3, 10, 8]. Differencing it the second time gives: [-3-4, -10-3, 8-10] = [-7, -13, -2]

- Taking the Log of the existing Time Series

- Taking the N-th root of the current series.

- Combining one or more of the above techniques.

Why is a Stationary Time Series important?

A stationary time series is comparitively easy to forecast and is more reliable. The reason being, forecasting models are fundamentally linear regression algorithms that employ the lag(s) of these series data to form predictors.

We also know that linear regression algorithms work best in scenarios where the predictors (X) are not correlated among each other. Making a time series stationary removes all and any incessant autocorrelation between the predictors, hence, making the series better for regression to perform. Once the lag(s) or predictors of the series are independent, the forecasting is expected to give reliable predictions.

Seasonality and Dealing with Missing Values

Seasonality in time series data is the presence of variations that occur at specific intervals of time that is less than a year. These intervals can be hourly, monthly, weekly, or quarterly. Various considerations such as weather or climatic changes can cause seasonality. These patterns are always cyclic and occur in periodic patterns. Understanding seasonality is important for businesses whose work depends on these variations like stock markets, labor organizations, etc.

Seasonal Variations have several reasons of study and significance:

- The explanation of seasonal effects on a dataset provides a detailed understanding of the impact of seasonal changes on the data.

- Once a seasonal pattern in established, significant methodologies can be employed to eradicate it from the time series. This will help in studying the effects of other components of the dataset that are irregular in nature. De-seasonalizing is the concept of eliminating seasonality.

- Historical patterns of seasonality and regular variations help in forecasting future trends of the similar data. For example, prediction of climatic patterns.

Treating missing values within Time Series

It is very common to observe missing data in any dataset. Similarly, for data representing time series, it is possible to observe the series with missing dates or times. It could either mean that data for that time period was not captured, or that it was not available. It is always possible that data was captured and was zero. In which case, the false negative needs to be ignored. Also, an important point to note is, mean or median imputation is not a good practice to follow for time series data. Especially, if the time series is not exhibiting stationarity. A better and more sensible approach would be to fill the forward data with historical values of that time frame.

However, based on the study of the time series data and the landscape of the series, there are multiple approaches that can be tried to impute missing values. Some noteworthy and common techniques of imputing missing time series values are mentioned below:

- Backward Fill

- Linear Interpolation

- Quadratic interpolation

- Mean of nearest neighbors

- Mean of seasonal counterparts

It is also important to measure the performance of the time series after the new values have been introduced to the dataset. It is considered a good practice to use two or more ways of imputing the values and then calculating the accuracy of the model using methods like Root Mean Square (RMSE). This helps in deciding which imputation technique is best suited for the data.

This chapter continues in the following part two.